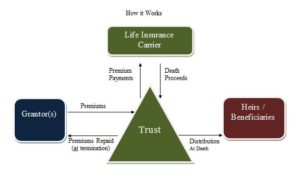

While there are various different ways to design a private split dollar, in a typical arrangement the insured(s) enter into an agreement with an irrevocable life insurance trust whereby the costs and benefits of the life insurance policy are split between them. The insured(s) pay the premiums on a life insurance policy owned by the ILIT, typically a joint survivor policy. Should the insured(s) pass away the ILIT would receive any death benefit above and beyond the greater of the policy’s cash value or the total premiums paid by the insured(s), and the insured(s) estate would receive the remainder. The ILIT would then pass on the death benefits to the beneficiaries based on the terms of the trust. The policy is not included in the gross estate of the insured(s) however the amount received by the insured(s) estate is included. The annual premiums are not treated as gifts for gift tax purposes. The amount of the annual gift is the economic benefit of the death benefits retained by the ILIT determined based on the appropriate government table (table 2001).

ADVANTAGES

- Allows the insured(s) to fund the purchase of life insurance in an ILIT without triggering gift taxes or reducing their lifetime gift tax exemption.

- The value of the annual gift for gift tax purposes (economic benefit) will be substantially lower, especially in the early years, than the annual loan interest if structured as a loan.

- Gives the insured(s) some flexibility should the need for life insurance diminish (i.e. the estate tax laws change)

USING A GRAT AS A PRIVATE SPLIT DOLLAR EXIT STRATEGY

A Grantor Retained Annuity Trust (GRAT) is a tax efficient, well established, technique for transferring assets to the next generation. In a Grantor Retained Annuity Trust (GRAT) the grantor transfers an asset to an irrevocable trust in return for an annuity payment, typically for a term of years. The annuity payment is a fixed amount based on a percentage of the asset transferred and must be paid at least annually. At the end of the term period the amount remaining in the trust is distributed to the beneficiary chosen by the grantor. For gift tax purposes the value of the gift on the date of the transfer is equal to the current value of the transferred asset minus the value of the retained annuity interest measured by using the IRS Sec. 7520 rate. In order for the GRAT to be successful the rate at which the asset appreciates inside the GRAT needs to be greater than the IRS assumed rate of growth (IRC Sec. 7520). Should the grantor pass way during the term of the GRAT the property is brought back into their gross estate and is subject to estate taxes.

By making the ILIT the remainder beneficiary of the GRAT the ILIT will have assets available to pay back the grantors under the terms of the private split dollar agreement. This will allow them to terminate the split dollar agreement and avoid being subject to increasing gift tax exposure.

*This material does not constitute tax, legal or accounting advice and neither Bowen,Miclette & Britt Insurance Agency, LLC nor any of its agents, employees or registered representatives are in the business of offering such advice. It was not intended or written for use and cannot be used by any taxpayer for the purpose of avoiding any IRS penalty. It was written to support the marketing of the transactions or topics it addresses. Comments on taxation are based on our understanding of current tax law, which is subject to change. Anyone interested in these transactions or topics should seek advice based on his or her particular circumstances from independent professional advisors.